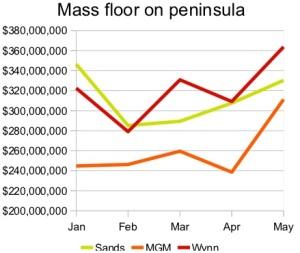

Looking back at the numbers for May, there is one that really stands out on the peninsula. And no, it’s not Wynn’s staggering jump from HK$45 billion to HK$60 billion in rolling-chip turnover; we have already covered that in previous e-newsletters. It’s the 30 per cent jump in mass gaming floor revenue at MGM Macau.

We understand there are changes underway at the property at the end of the street that don’t involve rearranging Macau’s traffic grid. With a proposed IPO in the planning, it wouldn’t need a rocket scientist to predict that management there are interested in jacking up their numbers. But what we have heard about so far involves mostly plans for ramping VIP play. We are not aware that anything drastic has been changed on the main gaming floor. Why, therefore, the sudden jump in mass revenue?

One reason may just be blind luck. Visitor arrivals are jumping again from the mainland (up 43 per cent year-on-year in May under the IVS) and it may just have been that a disproportionate number decided to walk the extra few meters to reach MGM, and they lost more there than they usually do. Another more plausible reason is that Encore didn’t just draw new business to Wynn, but also to MGM, whose casino main entrance sits directly across the road. Wynn saw its mass revenues jump nearly 18 per cent in May, and MGM was coming off a lower comparative number, so its surge could largely have been a case of piggy-backing. But another, more interesting reason to consider is that MGM has crossed a threshold of sorts on its mass floor, where critical mass begets critical mass. It’s the old analogy of the restaurant that’s full: passers-by assume it must serve great food, and so they queue up outside, attracting more interest, and so on. We have noticed what appear to be good attendance figures on the MGM floor this month; so perhaps word is getting out that the place has a better vibe.

One reason may just be blind luck. Visitor arrivals are jumping again from the mainland (up 43 per cent year-on-year in May under the IVS) and it may just have been that a disproportionate number decided to walk the extra few meters to reach MGM, and they lost more there than they usually do. Another more plausible reason is that Encore didn’t just draw new business to Wynn, but also to MGM, whose casino main entrance sits directly across the road. Wynn saw its mass revenues jump nearly 18 per cent in May, and MGM was coming off a lower comparative number, so its surge could largely have been a case of piggy-backing. But another, more interesting reason to consider is that MGM has crossed a threshold of sorts on its mass floor, where critical mass begets critical mass. It’s the old analogy of the restaurant that’s full: passers-by assume it must serve great food, and so they queue up outside, attracting more interest, and so on. We have noticed what appear to be good attendance figures on the MGM floor this month; so perhaps word is getting out that the place has a better vibe.

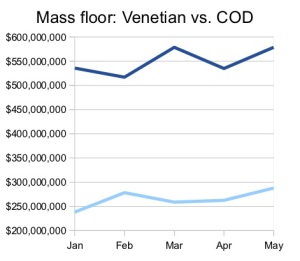

We can only assume that the gents across the water at City of Dreams must have looked enviously at those numbers going through MGM. Although everyone gained from the rising tide of mass-market arrivals in May, as you can see from the attached charts, there is a closer correlation between MGM and Wynn than there is between Cotai No. 2 and Cotai No. 1. Not that Sands China has too much to crow about, though: its big box on the peninsula has not exactly been keeping up with the Joneses.

We can only assume that the gents across the water at City of Dreams must have looked enviously at those numbers going through MGM. Although everyone gained from the rising tide of mass-market arrivals in May, as you can see from the attached charts, there is a closer correlation between MGM and Wynn than there is between Cotai No. 2 and Cotai No. 1. Not that Sands China has too much to crow about, though: its big box on the peninsula has not exactly been keeping up with the Joneses.

We only wish that we had numbers for the Grand Lisboa to put in here alongside Wynn, MGM and Sands. We suspect it would be ahead of all three. Which, in the bigger picture, augurs well for those properties near the intersection of Avenida da Amizade and Avenida da Lisboa, suggesting they are building critical mass among people who walk all three properties, perhaps at the expense of the neighborhood around the ferry terminal. This is a trend worth watching more closely over the coming weeks and months as tourism arrivals continue to grow strongly. Don’t be distracted by the headline VIP numbers: mass is where the margins lie.

Used with permission & copyright to IntelMacau